"Subliminal Sustainability: Alberta’s Journey toward SDGs and the Cost of Compliance"

not all dangling carrots are equal

When your insurance offers you a discount maybe have a closer look at the underlying reasons. Several Canadian insurance companies offer discounts for low-mileage drivers, rewarding those who drive fewer kilometers annually. These incentives are designed to lower premiums, often by 5% to 50%, depending on the insurer and driving habits. Here are some examples of companies that provide such discounts:

Alberta Motor Association (AMA) MyPace is a distance-based insurance product where, alongside a fixed fee for things like theft and hail, policyholders only pay for the number of kilometres their vehicle is driven.

Allstate Canada: Their Milewise program uses a pay-per-mile approach, helping drivers who travel less save on their premiums. They track mileage using a device installed in the vehicle

State Farm: Their Drive Safe & Save program offers up to 30-50% savings based on overall driving behavior and mileage, tracked via a beacon and app

BrokerLink: Specializes in helping low-mileage drivers find policies tailored to their needs, offering quotes that compare various options for reduced mileage drivers

HUB Insurance Hunter: This broker works with several major insurers like Aviva, Economical, and Wawanesa, offering low mileage discounts to drivers who keep their yearly mileage under certain thresholds

Let’s explore AMA offer:

Copied from https://ama.ab.ca/insurance/vehicle/auto-insurance/ama-mypace (my comments are in brackets italics)

Is AMA MyPace for you?

AMA MyPace is ideal for vehicles driven less than 9,000 km/year. This program may be a great option if you: (if you don’t mind being completely tracked ALL the time)

Work from home full-time or have a hybrid work arrangement. (as in the lockdown phase)

Are retired and drive infrequent, short trips.

Typically commute by bicycle or public transit. (push push nudge nudge…will they have a lottery soon to get you to sign up?)

Have more vehicles than drivers in your household or a have seasonal vehicle.

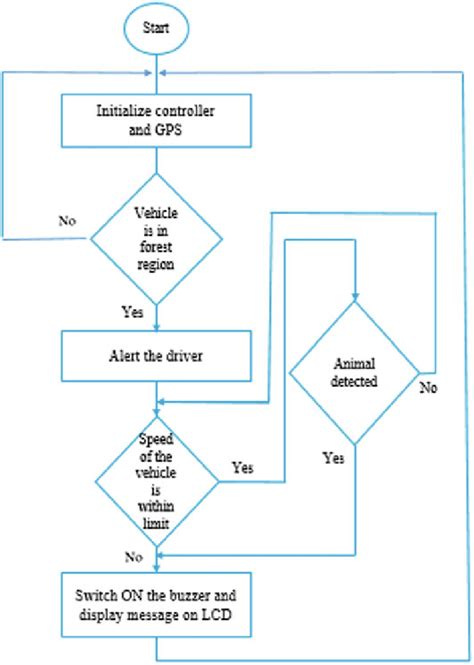

If you typically drive to work every day, you likely drive more than 9,000 km/year and AMA MyPace won’t be a good fit for you. Instead, you may want to consider signing up for AMA MyRide, an app that raises awareness of driving behaviours and provides savings for eligible drivers just for signing up. (can you spell surveillance? again voluntary for now )

AMA MyPace is available on an Alberta Motor Association Insurance Company personal auto insurance policy. It’s completely voluntary, (for now) so if your current auto insurance is working for you, there is no obligation to change.

Great Driving Means Great Savings! (oops did you mean Great Control and even more intrusive methods to monitor your habits)

AMA MyRide is a mobile app that records and scores your driving performance. Just signing up could save you up to 10% off your auto insurance (so I ask what price do you put on your privacy) and if you're a safe driver, you could save even more in the future. (makes no mention of what happens if your habits are not at their standards-see it is all about the future and don’t kid yourself they will use the information that you voluntarily signed up for to use against you.)

(We already give up a lot of data and privacy to corporations, and we shouldn’t be giving all of this information up to insurance companies. We want insurance to be used to accurately match rates to risk and to help consumers; we don’t want people and their information to become products.

— Michael DeLong, Research and Advocacy Associate, Consumer Federation of America (CFA)

This looks more like Coerced Compliance

Programs that reward low-mileage driving may subtly encourage individuals to conform to specific driving behaviors aligned with broader societal goals, such as reducing carbon footprints. Is this as a nudge towards compliance with environmental narratives? even if individuals may not personally subscribe to these views .

In a challenging economic environment, the allure of savings from such insurance programs can compel individuals to participate in initiatives that may infringe on their privacy or autonomy. The "carrot" of savings may overshadow concerns about the implications of sharing personal data.

As these programs gain traction, there is a risk of normalizing surveillance in everyday life, OR IS THAT THE GOAL? Increased acceptance of monitoring systems could pave the way for more extensive tracking in other areas.

The integration of insurance incentives with public policy can create a framework where individuals are incentivized to comply with regulations under the guise of economic benefits. This could lead to a slippery slope where more intrusive policies are justified by economic motivations.

Although I am sure they tell you your data will be kept confidential and secure kinda like safe and effective, it should raise questions about how this information is used and stored. For example, there's the risk that insurers could share data with third parties or that it could be misused to deny claims or increase premiums based on perceived risk.

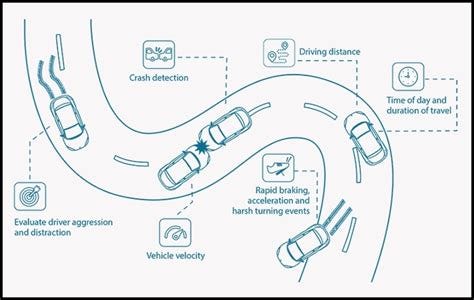

In today's world, where boundaries between right and wrong can often feel blurred, the idea of trusting the insurance industry with personal data, especially through telematics there are several reasons why people might be hesitant or even "foolish" to place such trust in an industry known for its complex relationship with consumers. The insurance industry is ultimately driven by profit, and data is a valuable commodity. While insurers may present telematics and data-collection devices as a way to offer discounts and promote safer driving, the collection of detailed personal data allows them to create extremely specific risk profiles. This raises concerns that such information could be used against consumers, leading to higher premiums or denied claims, especially when data reveals risky behavior. And if that isn’t a deterrent enough there is always the potential for insurers to sell or share this data with third parties, such as marketing firms, without consent.

While auto insurance programs that track driving behavior may offer financial incentives, they also present significant risks in terms of privacy, personal freedom, and the potential for misuse of data. As data has become the new currency in our digital world, trusting industries driven by profit and with limited regulation can lead to unintended consequences. The "carrot" of lower premiums could easily turn into a system of control, where personal habits are monitored, judged, and used to manipulate individuals into compliant behaviors, all in the name of savings.

and so one must ask themselves WHAT AM I REALLY SAVING?

Trust your gut not your insurance SALES PERSON.

Hits the nail on the head, once again! Connie writes one of my all-time favorite substacks.

We are facing the same programs in the US. That's hardly a surprise!

Voluntary for now is mandatory in pretty much no time.

All of this, of course, is coming directly from the Unelected Nobodies, the UN. Visit PreventGenocide2030.org to take the 10 Million Patriot Challenge. Visit StopC-293.ca to make the operationalization of the UN's tyrannical Sustainable Development Goals go away before they completely dissolve whatever Canada is (or was). This horrible Bill is a hair's breadth away from passing. Stop it now.